When I was just starting out in crowdfunding, I spent a lot of time at access-to-capital events for entrepreneurs and small business owners. At every event I heard a bank or CDFI representative run through the 5 C’s of Credit, a framework used by lenders to assess the suitability of an applicant for a loan. And at every event I watched the shoulders of business owners slump over when they realized they didn’t have the 5 C’s of Credit. Some would even ask the presenters, “But what if I don’t have these qualifications?”

I always wanted to shout “Try crowdfunding!” from the floor because although crowdfunding has its own readiness checklist, it doesn’t look like the 5 C’s of Credit. I’ve experimented with a lot of ways to express those differences over the years, and recently had a light bulb moment. Why create a new framework? Why not use the same framework – the same 5 C’s – to explain readiness for crowdfunding AND to highlight how it differs from readiness for lending.

So…

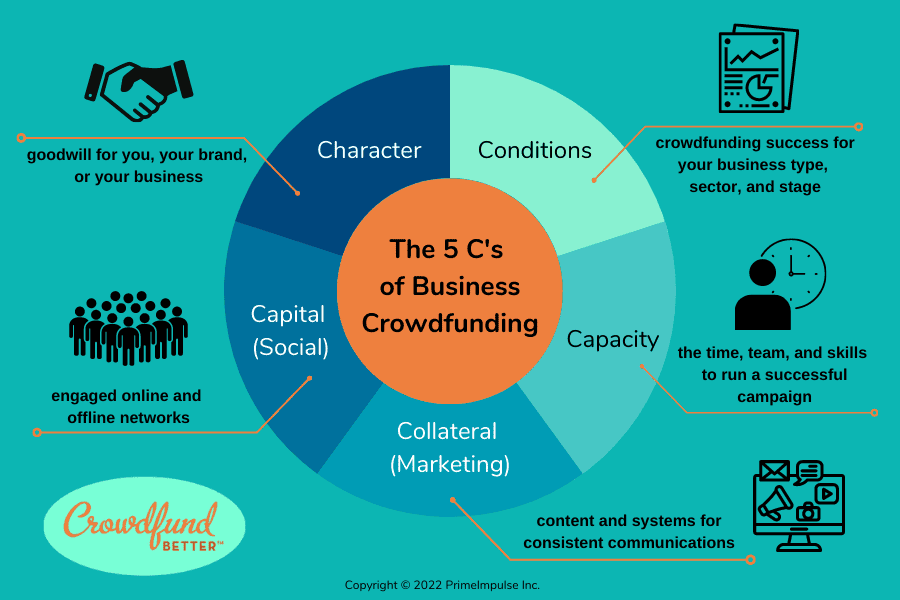

Meet the 5 C’s of Business Crowdfunding

CHARACTER

Let’s start with CHARACTER. When lenders talk about Character in the 5 C’s of Credit, they are primarily talking about credit history (i.e. personal and business credit scores). They may also look at a business owner’s industry experience.

Let’s compare that with CHARACTER in the 5 C’s of Business Crowdfunding. In crowdfunding, Character is about trust. It’s not about FICO scores, but the goodwill people have for you, your brand or your business:

For example, do people know you to be the kind of person who keeps your word – who walks your talk? Do people trust your brand to deliver quality? Do they love your business so much that they would go out of their way to visit your store even though the national chain is more convenient? That trust can be personal or professional, but the bottom line is people support the campaigns of the people, brands and businesses they know, like, and trust. (Nod to my colleague David Duccini of Silicon Prairie Capital Partners for that last bit.)

CAPITAL

When lenders talk about CAPITAL they are talking about the capital a business owner has invested in their business – what is commonly referred to as “equity injection” or “skin in the game.” Banks want to see that business owners have put their own assets into a business before issuing a loan.

In the 5 C’s of Business Crowdfunding, we’re not talking about financial capital, but SOCIAL CAPITAL. You might call it your social “skin in the game”:

Do you have engaged online and offline networks? Do you have a healthy network of personal contacts, business contacts, community supporters, fans, customers, subscribers, followers, influencers, and media contacts? And when we’re talking about networks, we’re not just talking about sheer numbers of contacts or followers. The other measure we need to take into account is the depth of your relationships. Just because someone follows you on social media doesn’t mean that they are interested enough to back your campaign. You’ll also need to take stock of the depth of your relationships with your community. Are they connected enough to take action to support you?

COLLATERAL

In the eyes of lenders, COLLATERAL is all about reducing their risk if a business defaults on their loan. Collateral refers to the assets a business owner pledges to repay a loan and includes “hard assets” like business equipment and real estate. For many start-up business owners without business assets, this collateral may also include their personal homes.

In the 5 C’s of Crowdfunding, we’re not referring to financial collateral or hard assets, but very valuable “soft assets” of a business: MARKETING COLLATERAL. This type of collateral includes what a business brings to the table in terms of their customer and subscriber lists, and their systems for consistent marketing communications:

Does the business have a healthy email or SMS list? Does it have an engaged following on social media channels? Does the business have a staff member or team focused on marketing the business? Do they use tools to organize their marketing like editorial calendars, email management services, and social scheduling tools? Is there a marketing budget already in place?

Crowdfunding success requires consistent efforts to reach potential backers before and during a campaign (and after to nurture these new backers into long-term customers). When you have marketing collateral already in place, or are willing to take steps to put it in place, you are ahead of the curve.

CAPACITY

When it comes to CAPACITY in lending, it’s pure math. Does your business have the ability to pay the loan you’re applying for? Banks and other lenders want to make sure your business has the income or expected income to pay all your regular business expenses and debts, plus your new loan payment.

In crowdfunding CAPACITY is a very different story. You’ll want to assess if your business has the time, team, and skills to run a successful campaign. Preparation for a crowdfunding campaign typically takes about 90 days and often much longer (6-12 months). Preparing for and running a campaign is also a time-consuming process:

Do you have some runway before you need the capital? Do you have the space to add crowdfunding to your plate or are you already maxed out? Do you have an in-house team to support you or do you have the budget to hire professionals to help you accomplish crowdfunding tasks? Do you and your team have the skills required to run a successful campaign? If not, do you have the budget to hire others who do?

You’ll also need to determine if you have the capacity to deliver on what you’ve promised to your campaign backers before you set out. Consider not just what it takes to launch and run your campaign, but also what it takes in terms of time and capital to deliver physical products (rewards crowdfunding) or to provide a return on investment to your supporters (investment crowdfunding).

CONDITIONS

What do the economic conditions look like for businesses in your industry or business as a whole? That’s what lenders are looking at when they are considering CONDITIONS in the 5 C’s of Credit. They may or may not be willing to lend to your business based on market analysis of trends in your industry and/or in your geographic location.

When looking at CONDITIONS through the 5 C’s of Crowdfunding, you’ll also need to consider trends, but in this case, successful crowdfunding trends:

What levels of crowdfunding success have businesses of your type, sector, and stage had with crowdfunding. In other words, have businesses that look like yours successfully crowdfunded? What types of crowdfunding do businesses like yours use – donation, rewards, microlending or investment? Have they been successful in reaching your desired funding goal? If yes, how many supporters did it take for them to reach those goals?

Much like you would check the weather before heading out of the house in the morning, understanding the existing conditions in the crowdfunding space will not only make your crowdfunding experience more pleasant, but also that much more successful.

Stacking Your Capital

What’s interesting about these two perspectives on the 5 C’s is that they can work together. A successful crowdfunding campaign could help you improve your chances of getting a loan, and a small loan could help you build the capacity to run a much larger crowdfunding campaign. Instead of looking for one capital solution, think about ways to stack your capital – crowdfunding to lending OR microlending to crowdfunding OR crowdfunding to investment – to reach your business goals.

Want some help assessing the 5 C’s of Crowdfunding for your business? That’s one of our specialties here at Crowdfund Better. Check out our Crowdfunding Roadmap Package – it’s the crowdfunding deep dive you didn’t know your business needed (until you read this blog).